Read the note: Bonside unveils $100M partnership with i80 Group

Defining the brick

and mortar economy.

Discover flexible, tailor-made financing.

Read the note: Bonside unveils $100M partnership with i80 Group

Defining the brick

and mortar economy.

Defining the brick

and mortar economy.

Discover flexible, tailor-made financing.

Read the note:

Bonside unveils $100M partnership with i80 Group

Bonside leads with the Evaluation: an AI-enabled credit view showcasing the health of any brick-and-mortar.

Bonside leads with the Evaluation: an AI-enabled credit view showcasing the health of any brick-and-mortar.

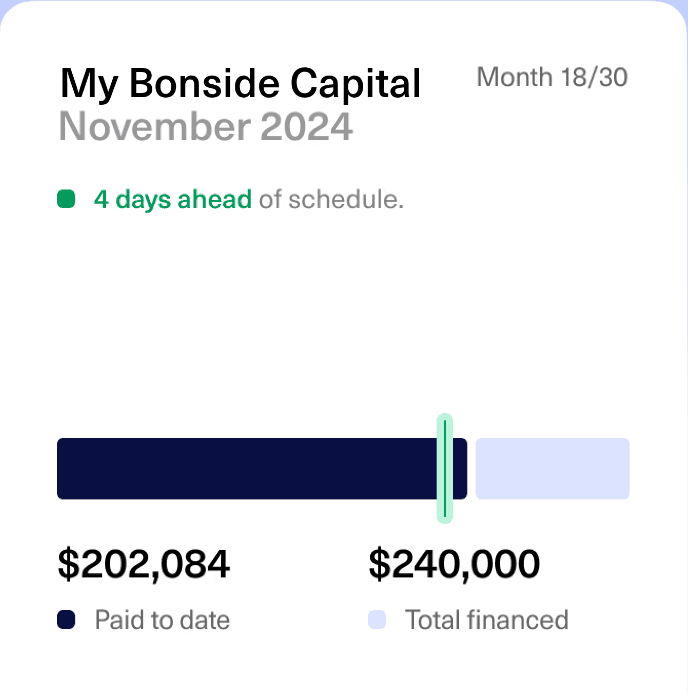

Bonside's Evaluation unlocks access to Bonside Capital: a non-dilutive, revenue-based financing vehicle for brick-and-mortars.

Bonside's Evaluation unlocks access to Bonside Capital: a non-dilutive, revenue-based financing vehicle for brick-and-mortars.

With the help of Bonside's Evaluation, institutional capital and real estate flow to the best brick-and-mortar businesses.

With the help of Bonside's Evaluation, institutional capital and real estate flow to the best brick-and-mortar businesses.

New locations

opened with Bonside.

José Andrés Group

15 locations, 8 cities

Y7 Studio

9 locations, 3 cities

SunLife Organics

20 locations, 7 states

New locations

opened with Bonside.

José Andrés Group

15 locations, 8 cities

Y7 Studio

9 locations, 3 cities

SunLife Organics

20 locations, 7 states

New locations

opened with Bonside.

José Andrés Group

15 locations, 8 cities

Y7 Studio

9 locations, 3 cities

SunLife Organics

20 locations, 7 states

Serving the brick and mortar economy.

For businesses, property owners, and investment institutions.

Learn about Bonside Capital.

Financing tailor-made for brick-and-mortar.

FOR PARTNERS

Bonside, Inc © 2025. All rights reserved.

Bonside.com is a website owned by Bonside, Inc., the parent company of Bonside Advisors, LLC. Bonside, Inc. hosts and operates bonside.com, a website that lists certain Regulation D offerings. Bonside, Inc. is not regulated in any capacity, is not registered as either a broker-dealer or funding portal, and is not a member of FINRA or any other self-regulatory organization. Bonside Advisors, LLC is an exempt reporting adviser that makes filings with the SEC and/or certain states. Bonside Advisors, LLC advises special purpose vehicles (SPVs) used in certain Regulation D offerings that are available on bonside.com. By using bonside.com, you accept our Terms & acknowledge that you have read our Privacy Notice. Investments listed on bonside.com involve risks, including the risk of loss of all capital invested.

FOR PARTNERS

Bonside, Inc © 2025. All rights reserved.

Bonside.com is a website owned by Bonside, Inc., the parent company of Bonside Advisors, LLC. Bonside, Inc. hosts and operates bonside.com, a website that lists certain Regulation D offerings. Bonside, Inc. is not regulated in any capacity, is not registered as either a broker-dealer or funding portal, and is not a member of FINRA or any other self-regulatory organization. Bonside Advisors, LLC is an exempt reporting adviser that makes filings with the SEC and/or certain states. Bonside Advisors, LLC advises special purpose vehicles (SPVs) used in certain Regulation D offerings that are available on bonside.com. By using bonside.com, you accept our Terms & acknowledge that you have read our Privacy Notice. Investments listed on bonside.com involve risks, including the risk of loss of all capital invested.